How Credit Score Affects Loan Approval is something everyone looking for financing should care about. That three-digit number can make or break your chances when applying for a loan, influencing whether you get a yes or a no.

Your credit score doesn’t just open doors—it decides how good the deal behind those doors will be. Lower interest rates, better terms, and faster approvals often go to those who’ve taken care of their credit.

Want to learn how to boost your chances and avoid costly mistakes? Keep reading and discover practical tips to take control of your financial future.

Understanding Credit Scores

Understanding credit scores is crucial for anyone looking for a loan. How Credit Score Affects Loan Approval is a key concept here, as lenders rely on that number to judge if you’re a good candidate for credit. The score ranges from 300 to 850, with higher scores reflecting better credit health.

Many factors affect your credit score, including payment history, amounts owed, and credit history length. Paying bills on time and keeping credit card balances low can improve your score. Knowing how these factors connect helps you make smarter financial decisions and directly impacts How Credit Score Affects Loan Approval.

Your credit score plays a significant role in loan approval. Lenders use it to determine the risk of lending you money. A higher score can lead to better interest rates and terms, making loans more affordable. By paying attention to your credit score, you can enhance your chances of securing loans when you need them.

Factors Influencing Credit Scores

Many factors influence your credit score, and understanding them is vital. One major factor is your payment history. Making payments on time shows lenders that you are responsible and reliable. Late payments, however, can lower your score significantly.

The amount of debt you carry also impacts your credit score. This includes credit card balances and loans. Keeping your credit utilization below 30% of your total credit limit is a good goal. This means if you have a $10,000 limit, try to keep your balance under $3,000.

Another important factor is the length of your credit history. Having older credit accounts can be beneficial, as it shows you have experience managing credit. New accounts can lower your average account age, which may hurt your score. Understanding these factors can help you manage your credit better.

The Loan Approval Process

The loan approval process starts when you fill out an application with a lender. This form usually asks for personal details, like your name, address, and income. The lender will also ask about your credit score, which they will check to understand your borrowing history.

Once the application is submitted, the lender reviews your information. They look at your credit score, income, and existing debts. This helps them decide if you can repay the loan. They may also ask for additional documents, like pay stubs or bank statements, to verify your financial situation.

If your application is approved, the lender will present you with loan terms. This includes the amount you can borrow, the interest rate, and repayment terms. Understanding these details is important, as they affect your monthly payments and overall loan costs. Knowing how your credit score plays a role in this process can empower you to make better financial choices.

How Credit Score Affects Interest Rates

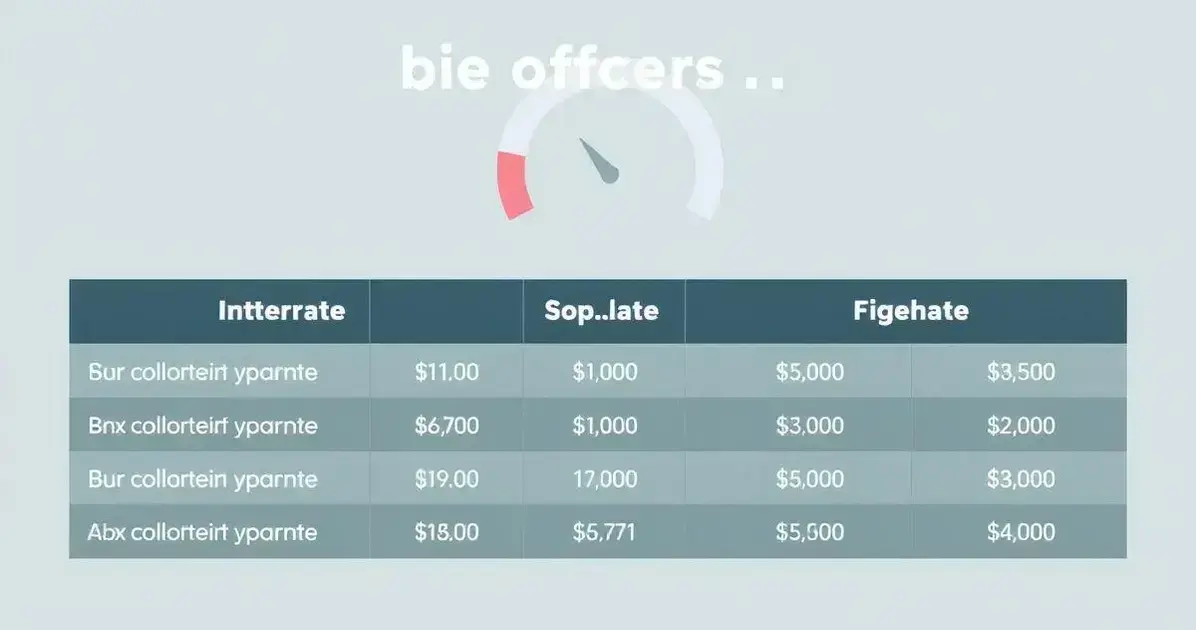

Your credit score has a big impact on the interest rates you receive when taking out a loan. Lenders use credit scores to help determine the risk of lending you money. If you have a high credit score, lenders see you as less of a risk, which usually means lower interest rates. Lower interest rates can save you a lot of money over the life of your loan.

On the other hand, if your credit score is low, lenders may view you as a higher risk. This often leads to higher interest rates. Higher rates mean you will pay more in interest, which can make your monthly payments larger and less affordable. Understanding this relationship can help you see the importance of maintaining a good credit score.

It’s also important to know that interest rates can vary between lenders based on your credit score and other factors. One lender might offer a rate of 4% for someone with a good credit score, while another might offer 5% or higher for the same person. Shopping around for the best rates can help you save money, especially if you have a strong credit score.

Tips for Improving Your Credit Score

Improving your credit score starts with paying your bills on time. Setting up reminders or automatic payments can help ensure you never miss a due date. Late payments can hurt your score significantly, so staying organized is key. Regular, on-time payments show lenders that you are reliable, which is crucial because How Credit Score Affects Loan Approval.

Another important tip is to keep your credit utilization low. This means using less than 30% of your total credit limit. For example, if you have a credit limit of $10,000, try to keep your balance below $3,000. By managing your balances and spending wisely, you can improve your credit score and positively influence How Credit Score Affects Loan Approval.

Finally, check your credit report regularly for errors. Sometimes, inaccuracies can appear on your report, which might lower your score. By disputing these errors, you can help ensure your credit score is an accurate reflection of your financial habits. Knowing your score and taking steps to improve it can positively impact your loan approval chances.

Common Misconceptions About Credit Scores

One common misconception about credit scores is that checking your own score will lower it. This is not true. When you check your own credit score, it is called a “soft inquiry,” and it has no impact on your score. However, when a lender checks your score for a loan application, it’s called a “hard inquiry,” and this can slightly decrease your score.

Another myth is that carrying a balance on your credit card is better for your score than paying it off completely. In reality, paying off your balance in full each month is beneficial. It shows you are managing credit properly and helps keep your credit utilization low, which is great for your credit score.

People often believe that closing old credit accounts will improve their score. However, keeping older accounts open is typically better for your score. A long credit history can boost your score, as it demonstrates your experience with managing credit over time. Understanding these misconceptions can help you make informed decisions about your credit.

How Credit Score Affects Loan Approval: FAQ

What is a credit score?

A credit score is a number that reflects your creditworthiness, showing lenders how likely you are to repay your debts.

What factors influence a credit score?

Your credit score is influenced by several factors, including your payment history, the amount of debt you have, and the length of your credit history.

How can I improve my credit score?

By managing your credit wisely through timely payments and reducing debt, you can improve your score over time.